As a business owner, getting paid the right amount and, more importantly, on time will probably become one of your biggest headaches. Research shows that Australians are among the slowest in paying invoices, averaging 26 days late.

Without a streamlined invoicing process, you may experience delays in getting paid, and this can lead to stress, insomnia, depression, and extreme anger due to the problems that late payment causes.

Getting Started

Invoicing is a common practice for businesses where payment is not required upon delivery of goods and services.

You can be a sole trader offering creative services (e.g., copywriting, design, video editing) or provide professional services such as garden landscaping, accounting, or pest control, where you may have to provide a quote, get client approval, and deliver the work before getting paid in full.

As a consumer, you’re probably used to paying for goods or services on the spot. For example, at a restaurant after a meal, at a supermarket at checkout, or at a car wash. However, in many business-to-business transactions, payment is not required immediately, and in some business-to-consumer trades, invoicing is becoming more prevalent.

Components of an Invoice

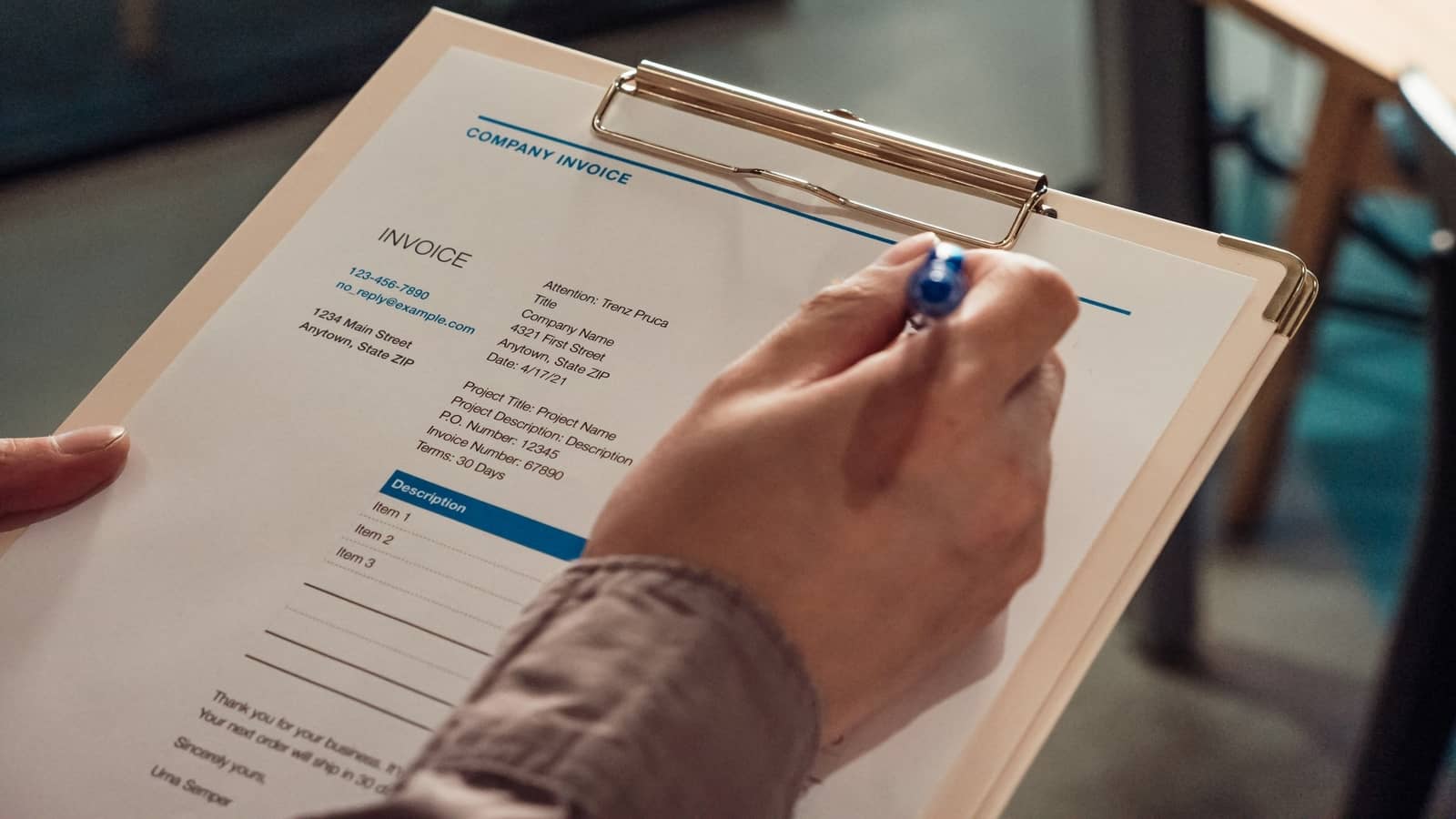

An invoice is a payment request, and in Australia, it must follow ATO guidelines. They can be digital or physical (e.g., printed on paper).

You can find free invoice templates in Google Docs, Canva, Google Sheets, Microsoft Office, and Adobe, and many invoicing solutions, such as Xero and MYOB, have them built into their service. For in-depth guidance, read ‘tips for using a sole trader invoice template’ by Westpac.

Specifically, your invoice template must include:

- Your ABN (click here to apply if you don't have this yet)

- A table that details the quantity and description of the goods and services you have provided

- The date the invoice was issued

- Any GST amount(s) if applicable.

In addition to these, it is advisable to include the following as well:

- Your contact information, so that if there is something that your customer wants to clarify, question, or dispute, they can do so without ignoring the invoice altogether

- When payment is required

- Address the invoice to an appropriate person in an organisation or business.

Payment Methods for Sole Traders

The purpose of an invoice is for you, as a business owner, to get paid. After all, profits require revenue, and having a consistent flow of income is one way to stay in business. This is why you should consider offering several payment methods that make getting paid as frictionless as possible.

This can include BPAY, electronic bank transfer, EFTPOS, and credit card processing. Most business bank accounts include several BPAY transactions for free, and electronic bank transfers are feeless.

Accepting credit cards and EFTPOS, however, will usually cost you something called a merchant fee, and depending on the volume and size of your transactions, the fee you will pay per transaction will vary from less than 1% to up to 3% of the transaction.

Even though accepting credit cards will eat into your margins, this form of payment is the most frequently used payment method in Australia, representing just over 60% of the total number of consumer retail payments.

Dealing With Late Payments

Therefore, include a choice of payment methods that make paying you as easy as possible, with clear instructions on how to do so on your invoice.

For example, provide your biller code and customer reference number for BPAY, or provide your BSB, account number, and account name for electronic bank transfers.

If you haven’t already done so, this may be the right time to learn why you should consider setting up a separate business bank account. Now, what happens if you’ve followed all the instructions so far and your client is late to pay you?

The Australian Small Business and Family Enterprise (ASBFEO) shows how to deal with an unpaid invoice. You will even find a dispute support tool that will help you find low-cost dispute resolution services to help resolve matters such as unpaid invoices.